February 2022 - Week 3 Edition

How to Handle the New Safety Deposit Box Dilemma

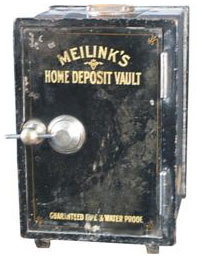

I have long recommended that clients store most of their valuable coins in a bank safety deposit box or security deposit center and I am in touch with many law-enforcement people, including retired FBI agents and police chiefs who share the belief that you are far safer storing your coins in a safe facility off-site. I also serve on the board of the Crime Stoppers of Southeast Texas. You may prefer to have personal and handy access to your coins at home, but criminals who gain access to your home can force you to divulge the contents of your safe by threatening bodily harm or worse. It’s not worth the risk.

Neither do I recommend burying coins in remote areas as you may become incapacitated and unable to retrieve the coins. There is also a risk of fire or flooding at home. The potential for flood damage is one reason why I recommend that you select a safe deposit box well off the floor level in the bank, preferably at chest level if you live in an area like ours where there is potential flooding. (I have many other recommendations on safe storage in our Numismatic Literary Guild and Press Club of Southeast Texas award-winning Gold Guide. Ask your representative for a free copy.)

But now, some new investors face a dilemma. I recently received a notice with one of my bank statements from JPMorgan Chase that they are no longer renting new safety deposit boxes. A few clients across the country have called in about the same kind of letter they received. The bank is saying, in essence, they will honor the existence of current safety box contracts, but they are not offering new deposit boxes. I asked around with a couple of bank executives I know, and they were cautious about how they described the situation, but they basically said that “regulatory messaging of the current administration” was raising concerns about making new safety deposit box contracts. Another bank executive said they would open a new safety deposit box “as long as you do business with us,” that is, you have some other type of banking account there.

So, the solution to this dilemma is that you need do nothing if you already have a safety deposit box in a bank you can trust – a bank that has always given you access when you need it. If you do not have such an account, you need to find out if your bank will open one for you and, if not, then go shop for a bank which will allow new safety deposit box accounts. If you are a good customer, maybe your current bank will make an exception in your case.

Valentine Gold

On Monday, February 14, gold sent a valentine to gold investors as it closed at an eight month-high of $1,872. Gold had not closed above $1,870 since June 11, 2021. Overnight, gold hit $1,880 but then fell to $1,850 when Russia pulled some troops back from the Ukrainian border. The rise began last Friday, when gold shot up from $1,825 in morning trading to close above $1,860. The main cause for the weekend rise seems to be the escalating tensions on the Ukrainian border between Russia and Ukraine, not to mention the U.S./Canadian border with the Canadian truckers’ strike. Even though inflation is sky high and still rising, gold’s chief engine now seems to be its role as a “crisis hedge” over a looming war in Ukraine.

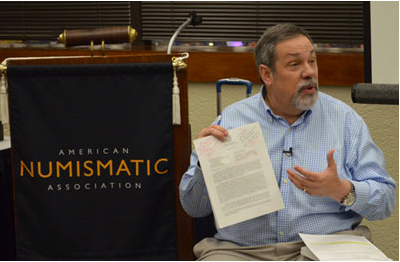

Goldman Sachs is “Almost Alone” in Being Bullish on Gold in 2022

As usual, the big banks are skittish on making bullish gold predictions when gold’s price is down, as it was in 2021. Gold closed the year in slightly negative territory, so many major banks predicted a flat or slightly negative performance for gold and silver in the year ahead. In mid-January, The London Bullion Market Association (LBMA) staged their annual survey of price predictions. This year’s survey was a “non-event,” in that 34 analysts from 18 cities around the world seemed to be looking for hiding places in the anonymous middle so that they did not have to stand out for being too bullish or too bearish. In effect, the LBMA is predicting a totally flat price for gold this year, neither up nor down. As of their January 14 filing, they see a modest gain in silver (+3.6%) and palladium (+3.8%) and +10% in platinum.

The Lonely Bull (to quote a Herb Alpert Tijuana Brass hit song from 1962) is Goldman Sachs. In late January, they upped their already bullish 2022 prediction of $2,000 gold to an even more bullish $2,150 gold price. Despite a dismal 2021, they reasoned that many of last year’s negative trends will reverse:

“Today, the global growth-inflation mix is markedly different. While there is not yet talk of recession, our economists forecast a material deceleration in U.S. growth,” Goldman said. “For investors looking for a way to hedge their portfolios from risks of a growth-slowdown and falling valuations, we believe a long gold position would be more effective in the current macro environment.”

Goldman adds something that we’ve been saying all along – that, “Contrary to many investors' expectations, gold has remained very resilient during the recent increase in U.S. real rates.” Goldman even says that gold could reach $2,500 per ounce if the economy slows while inflation continues to rise.

“As U.S. growth continues to slow in 2022, the market perception of recession probability could increase further… This sets gold up for greater investor interest despite rising rates…. We estimated that if inflation were to structurally move to 4%, gold could hit $2,500/oz based on the historical gold inflation relationship. We also estimated that gold would get somewhere close to this level if U.S. gold ETFs would move back to their 2011 highs. Therefore, we think there is considerable upside potential in gold in a scenario where inflation increases significantly.”

Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher.