March 2022 - Week 2 Edition

$2,000 Gold: Goldman (and We) Were Right – While the Bullion “Experts” Were Way Wrong

Less than a month ago, I commented on how skittish the mainstream bullion banks were in their annual predictions on gold. I didn’t even want to name specific banks since I didn’t want to embarrass anyone, but major European, Canadian and U.S. banks were predicting gold prices averaging $1,800 or lower in 2022, falling to $1,700 next year. A major Australian bank predicted prices could fall to $1,750 by June and then $1,600 by December, averaging $1,725 for the year, then $1,400 by September 2023, “averaging $1,458” for 2023. Give them credit for being specific! There was also a major Dutch bank that predicted gold prices averaging $1,500 this year, falling to $1,300 in 2023 but those weren’t the only downbeat predictions.

In January, the London Bullion Market Association (LBMA) polled 34 analysts in 18 major cities around the world and they averaged a very flat price for gold this year and a modest 3.6% gain for silver. As I mentioned in mid-February, the “Lonely Bull” was Goldman Sachs. In late January, they increased their already bullish 2022 prediction of $2,000 gold to an even more bullish $2,150 gold price. Despite a dismal 2021, they reasoned that many of 2021’s negative trends would reverse. They also said gold could go much higher, up to $2,500 per ounce, if the economy slows while inflation continues to rise.

“We estimated that if inflation were to structurally move to 4%, gold could hit $2,500/oz based on the historical gold/inflation relationship. We also estimated that gold would get somewhere close to this level if U.S. gold ETFs would move back to their 2011 highs. Therefore, we think there is considerable upside potential in gold in a scenario where inflation increases significantly.”

And, sure enough, inflation has been increasing each month this year. Last week, Fed Chairman Jerome Powell went before Congress to give what turned out to be his “State of the Economy” talk, and admitted one more time what I have been saying for almost a year now, that “inflation was not as transitory as we had hoped.” He tried to excuse his error by saying, “Other mainstream economists and central banks around the world made the same mistake. That doesn’t excuse it, but we thought these things would be resolved long ago.” Well, all the free-market economists I know, knew he was wrong!

There’s no way these major banks (or I) could have known that Russia would invade Ukraine. It was not really in Vladimir Putin’s best long-term interest to be an aggressor and a pariah on the world stage, but that is not the main reason gold is so high. It is high due to chronic inflation and a wide array of crises and uncertainties, of which Ukraine is only one. China and the status of Taiwan are equally serious, probably more so in the long run, as is the stability and nuclear balance in the Middle East. Given those factors, Chairman Powell’s comments to Congress only show how “clueless” the Fed’s 300 PhD economists can be about inflation.

Remember what happened when Russia invaded Afghanistan in December 1979 in a similar surprise attack, right after Christmas. Gold doubled in short order from $400 to over $800 per ounce. Gold will not likely double that fast this time around but surprise invasions like this can send gold soaring fast.

America’s Gold Expert Predicted Gold’s Rise

Gold topped $2,000 per ounce on Monday, March 7, so it already fulfilled our annual minimum prediction of $2,000 per ounce in the first 10 weeks of the year, despite the downbeat predictions of nearly all the professional bullion analysts in the U.S., London and the rest of Europe. Previously, GOLD hasn’t been over $2,000 since August of 2020. Silver was also higher topping $26 in early trading, its highest levels since last July – and it’s outperforming gold, so far.

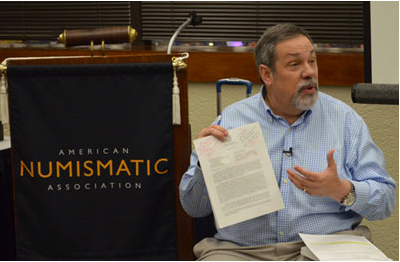

For the record, I predicted gold prices at $2,200 an ounce in 2022 and possibly going even higher based on other factors including inflation and the possibility of geo-political conflicts around the world. There is a reason why I am recognized as America’s Gold Expert. Historically, my predictions on precious metals and rare coins have often been correct because they are based on proven market factors and historical data that I routinely review. With a rising gold and silver market, more people buy gold and silver for the first time and we know that a good percentage of new bullion customers become rare coin investors and collectors over the next two years. This, in turn, drives up the demand and prices of rare coins in the rare coin market.

Gold and Silver Are a Good Hedge but You Need a Diverse Portfolio

#1: Don’t Put All Your Eggs in One Basket. We constantly urge investors typically not to put more than 25% of their investible dollars in any one investment category – like stocks, bonds, certificates of deposit, real estate and gold coins. There may be some exceptions to this advice due to unusual circumstances or opportunities but typically that’s what I and others advise. At one point, I demonstrated this on top of a building by dropping a basket of eggs, showing how all the eggs were shattered at once. Unfortunately, some on-lookers from a nearby nursing home got concerned and called the police, thinking that somebody was contemplating suicide up there. Well…. I got my point across to those at my seminar. It’s important to have a wide variety of investments, where one class of investments can “zig” while the others “zag.” Very often, your stocks will fall while gold rises, while the opposite might happen at other times. You must diversify. The World Gold Council has studies supporting the benefits of diversifying a portfolio with gold coins.

#2: There is No Santa Claus in Numismatics. If you see a rare coin for sale at a substantial discount from its normal price, do not expect a bargain. It may be a falsely graded coin, a counterfeit, or a fraud. We recently heard from a client who sent us some $2.50 Indian gold coins graded by a company with some letters that were very close to “PCGS” or “NGC” but were not the precise letters of those respected grading services. The coins were graded MS-65 by this second-rate grading service and were not even worthy of a MS-60 grade, in my view. Since the coins were subject to a 15-day money-back guarantee, I urged this client to ask for his money back, or to seek legal for further help if that were no longer possible. if that were no longer possible. Be wary of something that seems “too good to be true,” since it probably is. There is no Santa Claus in the numismatic world.

#3: Buy Quality Coins from Someone Known for Expertise in the Field. Sometimes, you may pay a little bit more for the same grade rare or antique coin from a recognized expert in the field, but you will also likely fetch more for that coin later on, when you go to sell it, because the expert is selling you a “sight seen” coin, selected as a better coin, not a generic “sight unseen” coin marketed by so many other dealers who do not have the expertise or take the time to select the better coins in the field. I have graded coins at leading grading services and taught grading at seminars for decades. As you can see from our Website, I have an unprecedented number of industry awards in my 45 years of professional experience in the numismatic field. I am personally involved with reviewing or approving most of the high-end numismatic coins that we select and sell to our clients, so that you have the best opportunity to have a better coin for the grade compared to many other coin companies.

Important Disclosure Notification: All statements, opinions, pricing, and ideas herein are believed to be reliable, truthful and accurate to the best of the Publisher's knowledge at this time. They are not guaranteed in any way by anybody and are subject to change over time. The Publisher disclaims and is not liable for any claims or losses which may be incurred by third parties while relying on information published herein. Individuals should not look at this publication as giving finance or investment advice or information for their individual suitability. All readers are advised to independently verify all representations made herein or by its representatives for your individual suitability before making your investment or collecting decisions. Arbitration: This company strives to handle customer complaint issues directly with customer in an expeditious manner. In the event an amicable resolution cannot be reached, you agree to accept binding arbitration. Any dispute, controversy, claim or disagreement arising out of or relating to transactions between you and this company shall be resolved by binding arbitration pursuant to the Federal Arbitration Act and conducted in Beaumont, Jefferson County, Texas. It is understood that the parties waive any right to a jury trial. Judgment upon the award rendered by the Arbitrator may be entered in any court having jurisdiction thereof. Reproduction or quotation of this newsletter is prohibited without written permission of the Publisher.